2022 changes to Ad Valorem taxes

Each year, the Urban County Council weighs whether or not to change the Ad Valorem Tax rate - that process starts on Tuesday, August 16 in the Council Work Session.

Ad Valorem taxes are essentially taxes on personal property, with assets like real estate, machinery & equipment, motor vehicles, boats, personal planes, or agricultural products. Tax revenue received is distributed to a number of agencies in Lexington.

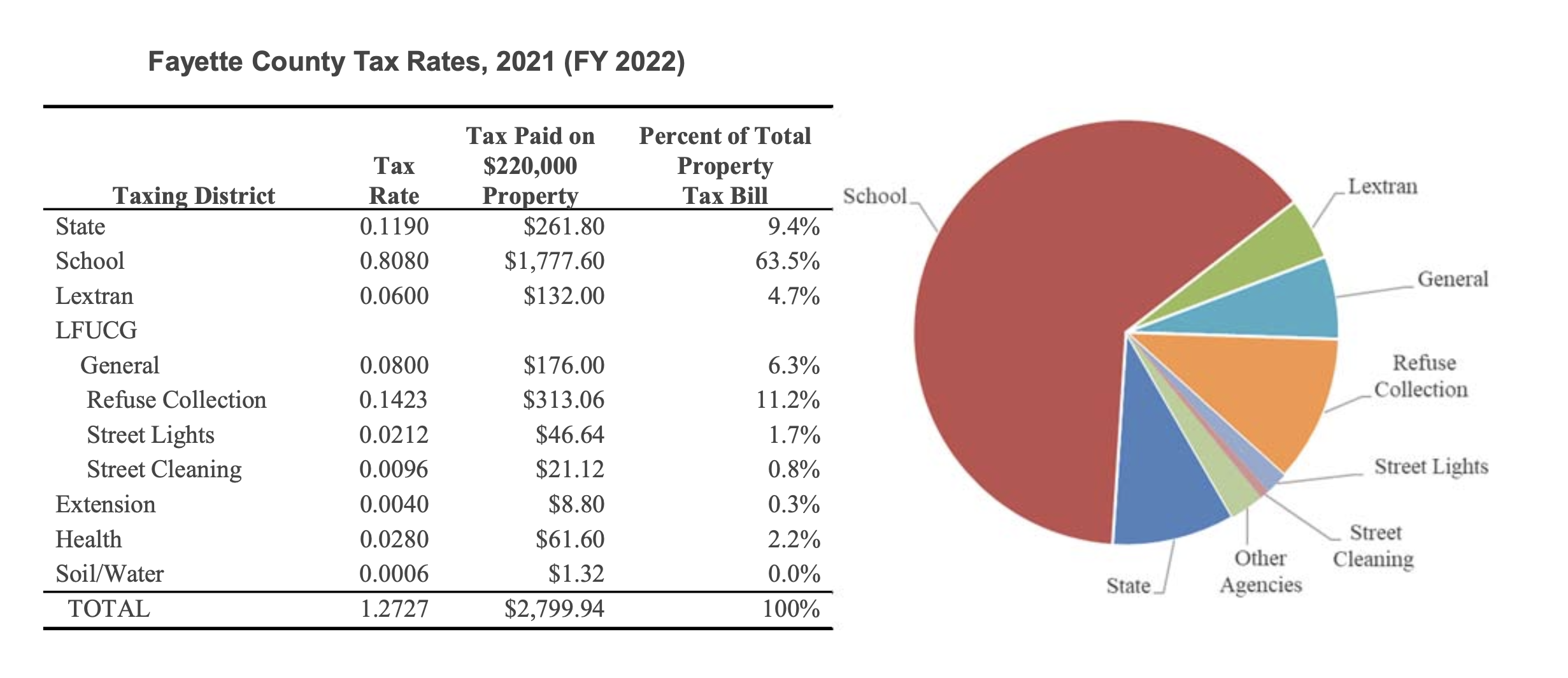

Thanks to this chart from LFUCG, you can see where these taxes go:

There are really two categories of Ad Valorem taxes that go to LFUCG - the General Fund and the Urban Services Fund (refuse collection, street lights, and street cleaning).

This year's Ad Valorem taxes look a little different than usual. Because of a greater than expected increase in property value assessments, the Lexington Public Library (which receives $0.05 of LFUCG's General Fund $0.08 per dollar share of the taxes) will receive an extra $1,008,530.

Each year, the Council is presented with a menu of options for how to modify the Ad Valorem rates. The Administration is recommending an option for a 4% change to Ad Valorem tax rates for both the General Services District Fund and the Urban Services District Fund. If approved, Ad Valorem tax rates will be lower this year than last year.

This change will have a -$252,530 impact on the city's fund balance from the General Fund Ad Valorem and a +$944,000 impact from the Urban Services Fund Ad Valorem rates.

For residents, here's the impact on home values: If you are paying taxes on a $220,000 home, you will pay $5 less in taxes this year to the General Fund and $11 less to the Urban Service Fund.

On Tuesday’s August 16’s Council Work Session, Council voted unanimously for the 4% Option. Council voted again for the rate change in Thursday’s First Reading. They will hold a Public Hearing and Second Reading during August 30’s Council Work Session.