Council to hear presentation on affordable housing needs study

In October 15th’s Council Work Session, Councilmembers heard a presentation from EHI Consultants on the results of their Affordable Housing Needs Analysis. In October 2023, Council allocated $188,000 to EHI to assess the exact housing needs of Lexington: how many units are needed, what income levels face the largest housing gaps, and more.

In many ways, this report is a follow-up to the 2014 Affordable Housing study done by the firm czb that led to the creation of the city’s Affordable Housing fund. It’s a very meaty, data-heavy presentation that we can’t fully capture, but we’ll break things down into a few key takeaways.

1.) Lexington’s rent has increased rapidly. The median rent increased 47% from 2019 to 2024, to $1,104. In 2017, the average rent was $839.

While these rental cost increases have been particularly pronounced in the past few years, it is also a continuation of a long-term trend. As recently as 2,000, nearly 50% of Lexington’s rental units were under $500 per month. By 2012, that number had fallen to 17%

Now, 54.3% of renters in Lexington are housing cost-burdened, meaning they spend more than 30% of their income on housing.

28% of households are extremely cost-burdened, meaning they spend more than 50% of their income on housing.

Lexington’s affordable rent conditions have mostly followed as predicted in the 2014 czb Affordable Housing study.

The most affordable areas of Lexington for non-subsidized housing are concentrated in the north side of Lexington, meaning residents have few geographic options for where to live if they have limited budgets.

While homeowners are less cost-burdened than renters, homeownership costs have risen as well.

21.5% of homeowners are cost-burdened, and 6.8% are extremely cost-burdened.

In January 2019, the median home sale price was $193,750. In January 2024, it was $310,343 - a 60% increase in five years.

On average, homeowners have higher housing costs than renters — but they also have higher incomes.

2.) There is not enough housing supply in Lexington. EHI contends that Lexington needs 22,549 additional housing units to meet current demand.

Lexington would need to increase its housing stock by 16% to fill this 22k unit gap.

17,005 units are needed for households with incomes at 80% or lower of the Area Median Income (AMI).

EHI identifies Lexington’s AMI as $62,908.

The overall housing unit demand figure in this report is almost identical to the 22,000 unit gap identified by the 2017 Lexington Housing Demand study, commissioned by a handful of Lexington organizations and agencies.

However, the 17,000-unit Affordable Housing gap is much larger than the 6,000-unit gap found by cab in 2014.

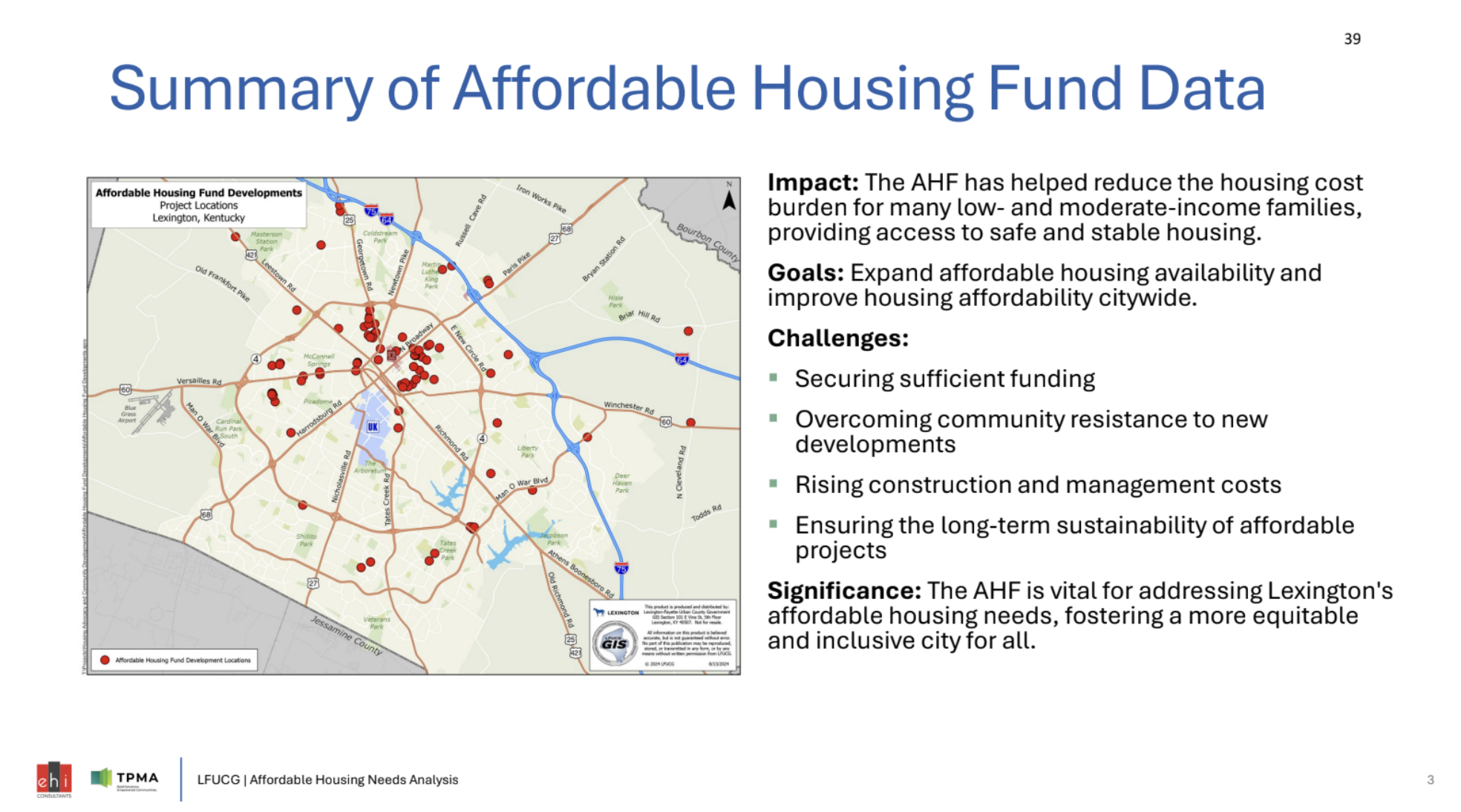

3.) Lexington’s Affordable Housing Trust Fund has had an impact, but it cannot solve the problem alone as it is currently designed. Lexington has invested $47.5 million since 2014 toward affordable housing, including:

The construction of 1,750 new affordable units, and;

The preservation of 1,754 existing affordable units.

The average per-unit investment from the fund is $13,556.

EHI calculated three potential scenarios for investment from the Affordable Housing Fund over the next ten years: closing the housing shortage gap, maintaining the gap at its existing level, or pursuing a modest reduction.

Closing the gap entirely would require a ten-year investment of $296.96 million, with a $25 million investment in year one.

Maintaining the gap would require an annual of investment of around $2.2 million.

Modestly reducing the gap would immediately require more money than the City dedicates by default to the Affordable Housing Fund. In 2023, the City changed its Affordable Housing funding scheme to dedicate 1% of the General Fund Revenue annually for the Affordable Housing fund.

In the current Fiscal Year 2025, that 1% dedication amounts to $4.75 million.

Year one alone of the modest reduction plan would require a roughly $6.78 million investment.

The ten-year total investment under this scenario would be roughly $79.55 million.

4.) There are affordability-focused policy solutions that Lexington can pursue. EHI proposed several ideas that Lexington can increase the supply and availability of affordable housing, some of which are completed or in-progress. Some of those include:

Removing regulatory barriers that inhibit the development of more affordable housing options, such as small single-family homes, accessory dwelling units (ADUs), or denser apartment buildings.

Pursuing inclusionary zoning, which creates requirements for a certain percentage of units in a development be affordable.

Supporting community land trusts, which allow for neighborhoods to preserve and develop permanently affordable residential and commercial property.

Creating stock development plans for homes and multifamily buildings that any developer can use and adapt to reduce development expenses and approval processes.

You can view the presentation slides starting on page 37 of this packet.